It is very important for someone who is just entering the equity investment market to understand some of the basic terms related to the stock market. Among several basic terms, there is Mcap, which means market capitalisation. Market cap represents the total value of a company’s outstanding shares, giving insight into its financial size and stability. For example, if a company has 20 million shares priced at Rs 200 each, its market capitalisation totals Rs 200 crore.

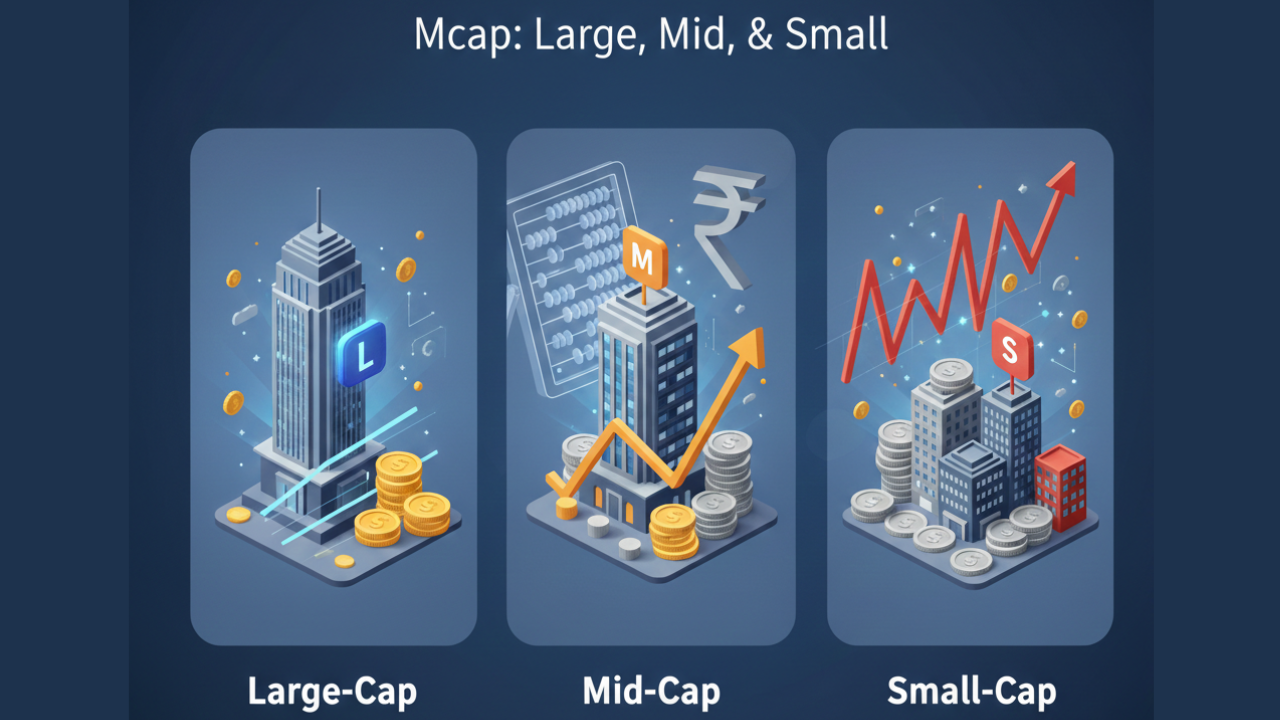

Market cap serves as a simple measure to categorise companies and assess their risk profile. Larger companies generally offer stability, while smaller firms may present higher growth potential but come with increased volatility. There are different terms based on the size of the companies: mid-cap, small-cap and large-cap firms.

What Are Large-Cap, Mid-Cap, and Small-Cap?

Large-Cap Stocks

These are the top 100 companies by market capitalisation and are often called blue-chip stocks. With strong brands, stable revenue streams, and consistent dividends, large caps are less volatile during market fluctuations and provide relatively safer investment options. They dominate their industries and can weather economic downturns more effectively than smaller companies.

Mid-Cap Stocks

Mid-cap companies fall between large and small caps, typically with market caps of Rs 5,000 crore to Rs 20,000 crore. They balance risk and growth potential, often showing strong earnings growth and the ability to scale into large-cap status over time. While they are more volatile than large caps, they may offer higher returns.

Small-Cap Stocks

Small caps include emerging companies ranked 251st and lower by market capitalisation. These firms are often regional or niche players with high growth potential but carry significant risk and volatility. They have limited analyst coverage, lower liquidity, and prices that can fluctuate sharply.

Diversifying across market-cap segments can strengthen portfolio resilience. Consider economic conditions, interest rates, and market trends before investing. Align investments with your risk tolerance and time horizon; small caps may require a longer-term approach, while large caps provide relatively stable returns.

Selecting stocks based on market capitalisation, alongside careful research and risk assessment, remains a foundation of sound investing.